As more of our lives and finances continue to migrate online, scammers have followed, targeting individuals through increasingly sophisticated schemes designed to steal personal details and drain bank accounts. While older generations have long been educated about common phone and mail scams, younger users now face new threats tailored to the digital world.

Recent data from the Federal Trade Commission shows the alarming scope of the problem. Americans lost a record $10 billion to fraud in 2022 alone, with an average reported loss of $1,965 per scam incident. And those figures likely only capture a fraction of the true costs, as many losses go unreported.

One such detailed scheme exposed by New York Magazine involved elaborate catfishing on Instagram. The scammer created fake profiles of attractive singles and befriended targets, even video chatting to build trust before convincing victims to invest in a supposed business opportunity. Over $500k was stolen from multiple people in a single operation that lasted months.

Experts advise consumers to be hyper-vigilant no matter their age or background, as scams are an “equal opportunity crime.” Simple precautions can go a long way, like verifying unsolicited contacts directly before acting on any requests involving personal details or money transfers. Legitimate organizations will never demand immediate payment or penalties be paid via untraceable methods like gift cards.

While technology connects people in positive ways, it also grants scammers new tools. Cryptocurrency demands are increasingly common thanks to the perception of anonymity. Fake investment or romance schemes using NFTs or decentralized finance protocols also emerged last year. Americans lost nearly $1 billion to cryptocurrency scams in 2021 alone according to reports.

For small business owners and consumers alike, staying informed is key to not becoming a statistic. Resources from groups like the FTC, SEC and local authorities can help spot common red flags across different platforms. Many communities also organize seminars for older residents susceptible to phone and email tricks. With billions at stake yearly as criminals up their game, awareness may be the best protection in an increasingly connected world.

How to Protect Yourself from the Rising Tide of Online Scams

Whether it’s receiving a suspicious text or email, getting a call claiming unpaid taxes, or coming across enticing opportunities on social media, today’s internet users must remain vigilant against scammers working harder than ever to deceive victims. Here are some of the most important tips for protecting yourself and your finances online:

Be wary of unsolicited contacts. Legitimate organizations will generally not contact you out of the blue requesting sensitive information like account numbers, passwords or demanding immediate payments. Do not feel obligated to act on threats without verifying claims independently.

Never click links or open attachments from unknown senders. Scammers use links and downloads to install malware that can steal data or compromise your devices. Hover over links to check for authentic URLs before interacting.

Be skeptical of too-good-to-be-true offers. Whether ads for work-from-home jobs paying thousands, easy investing platforms doubling money overnight, or promises of prizes requiring upfront fees – if an opportunity sounds unbelievable, it likely is.

Use strong, unique passwords. Reusing the same credentials across accounts leaves you exposed if one is compromised in a data breach. A password manager can generate and store secure passwords to help prevent damage from hacking or phishing.

Enable multi-factor authentication. Requiring a code texted to your phone in addition to a password makes accounts significantly harder for scammers to access, even if they have your username and primary credentials.

Review bank and credit card statements regularly. Look for suspicious charges and report anything unauthorized promptly to limit losses. Also check credit reports through AnnualCreditReport.com for unauthorized accounts.

Stay up to date on old and emerging scams. The FTC and consumer protection agencies provide detailed scam warnings. Familiarizing yourself with common tricks lets you spot anomalies and reconsider unsolicited requests with heightened skepticism.

Fraud prevention takes vigilance, but armed with awareness and safe practices, individuals can help flip the advantage back towards protecting themselves and their communities from ever-evolving cyber threats. With billions at stake each year, learning to spot and avoid scams should be a priority for all internet and finance users.

Here are some additional tips on how to protect your personal information from scammers:

- Be careful on social media. Don’t post too many personal details publicly and avoid friending/messaging unknown contacts.

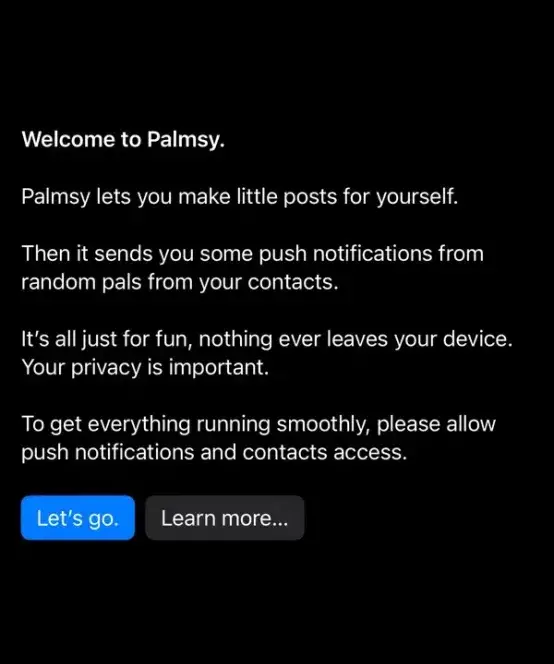

- Use privacy settings on apps and devices. Adjust what data is shared and only with trusted contacts/apps.

- Shred documents with private data before trashing. This includes billing statements, applications, unused gift cards, etc.

- Opt-out of marketing lists. Register with the Do Not Call registry and direct mail opt-out services.

- Monitor credit reports. Review full reports from all 3 bureaus annually in addition to monitoring for signs of fraud or identity theft.

- Beware of public WiFi. Avoid entering personal details on unsecured connections where data can be intercepted.

- Use firewall and antivirus software. Keep all devices and browsers updated to protect against emerging threats.

- Cover cameras and microphones when not in use. Simple precautions prevent potential spying risks.

- Use encrypted secure connections (HTTPS) for sensitive data transmittal. Look for the lock icon on credible websites.

- Limit personal data sharing. Give out ID, SSN or financial numbers only when absolutely necessary.

Being prudent about what information gets exposed online or offline makes it much harder for scammers to successfully impersonate or exploit victims.

ZMSEND.com is a technology consultancy firm for design and custom code projects, with fixed monthly plans and 24/7 worldwide support.